TAX ACCOUNTING SERVICES

During the 21st

century due to the global recession, a large number of people began looking for

the assistance of an accounting

consultant. We know there are many who have skills to perform accounting

services on their own but due to lack of knowledge regarding financial matters

and legal obligations, they step back. So, at that time they need help of a

person who may help them in getting all the services done, maintaining

compliance's and cuts costs, all while letting you focus on your core

competencies and grow your business.

We

provide following services so any person willing to take these services may

enquire now:

1. Permanent Account Number(PAN)

2. Tax Deduction Account Number(TAN)

3. Trademark registration

4. Director Identification Number

5. Income tax return filing

6. Proprietorship Registration

7. Service tax Services

8. Digital Signature Certificate

9. Return Filing Services like service tax

return, sales tax return, TDS return, income tax return, etc.

PERMANENT ACCOUNT NUMBER

A PERMANENT ACCOUNT NUMBER is a unique

alphanumerical combination which is issued by the Income Tax Department and it

is issued to all entities which are identifiable under the Income Tax Act 1961.

It is important to have with all the persons as it serves as an important proof

of identification. PAN number is mandatory for all financial transactions.

TAX DEDUCTION ACCOUNT NUMBER

A TAX DEDUCTION ACCOUNT NUMBER (TAN) is an

alphanumerical number which is issued to individuals. This number is issued to

those who under the Income Tax Act 1961 are required to deduct tax on payments

made by them.

We are providing PAN and TAN registration

services in a cost effective and timely manner.

TRADEMARK

A TRADEMARK is a recognizable sign, design or

expression which identifies products or services of a particular source from

those of others. The trademark owner can be an individual, business organization

or any legal entity.

A trademark is typically a name, word, phrase,

logo, symbol, design, or an image. The biggest benefit of getting trademark

registration done is that the owner of the mark can commence legal proceedings for trademark

infringement to prevent unauthorized use

of that trademark.

DIRECTOR IDENTIFICATION NUMBER

DIRECTOR IDENTIFICATION NUMBER (DIN) is a unique

identification number given to an existing or a potential Director of any

company which is incorporated. .

DIN not only helps in fixing the identity of the

director but also relates his participation in other companies. In case of any

change in address or any other particulars is faced by the DIN holder, they are

suppose to inform the Central Government about the same. So this keeps the

database ‘Live’ always.

We can provide DIN within a single day and that

too at an economical price.

INCOME TAX RETURN FILLING (ITR)

The Central Government has been empowered to levy

tax on all the incomes. The government of India imposes an income tax on taxable income of

all persons including individuals, Hindu Undivided Families (HUFs),

companies, firms, association of persons, body of individuals, local authority

and any other artificial judicial person. Levy of tax is separate on each of

the persons.

SOLE PROPRIETORSHIP

The most common and simplest form of business is

a sole proprietorship. Many small businesses operating in the United States are

sole proprietorships. There is no need to comply with any legal formalities

except for those businesses which require license from local authorities or

health department of government. A sole proprietor can own the business

for any duration of time and sell it when he or she sees fit. It can also

be less costly to start a business as a sole proprietor, which is attractive to

many new business owners who often find it difficult to attract investors.

SERVICE TAX

This service handles the requirements of services

which fall under applicability of Service tax Act. Service tax is a kind

of indirect tax, which is imposed on rendering services that are known as

taxable services. First step to use this service is to get yourself registered.

After getting registered, you will get a 15 digit Service tax Code which you

can mention in invoices and service tax returns. It includes Filing of Service

Tax return in ST-3.

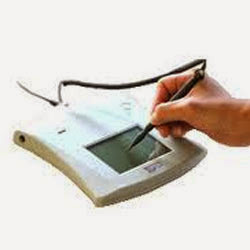

DIGITAL SIGNATURE CERTIFICATES

Digital Signature Certificates (DSC) are the

electronic format of physical or paper certificate. A digital certificate can

be presented electronically to prove your identity, to access information or

services on the Internet or to sign certain documents digitally.

RETURN FILLING

After getting various registrations done, one

might be requiring return filing services like Service tax return Filing, sales

tax return filing, TDS return filing, Income tax return Filing to comply with

various statutory provisions. We having expertise in diverse tax field can help

you out in fulfilling statutory compliances in a timely and hassle free manner.